INTRODUCTION

After nearly four years, Non-Fungible Tokens (also known as NFTs) have finally entered the spotlight. It is reported that $550m in transaction volume was generated from January to March of 2021, and that $200m of that figure occurred in the first half of March alone1. A popular question that many individuals have asked is, “Why would someone pay so much for an NFT?” In this chapter, we provide the answers to both: 1) What NFTs Are; and 2) How to Value Them.

Part I: WHAT ARE NFTs

NFTs first garnered the attention of crypto enthusiasts when CryptoKitties and CryptoPunks launched in 2017. The definition of non-fungible tokens can be broken up into two parts. First, non-fungibility simply means that the asset in question is distinguishable (from other NFTs) because there is an objective, verifiable uniqueness to them. In contrast, bitcoin and US dollars are fungible (or interchangeable) because there is no difference between two bitcoins or two dollars. Second, the proof of ownership for an NFT exists on the blockchain for everyone to see. Therefore, given that the information is stored on a blockchain, there is always total assurance that what you are buying is either 100% authentic or not.

Where NFTs ultimately thrive is convenient verification of ownership. Entrepreneurs are now leveraging these technologies to digitize and create NFT marketplaces for other assets such as in-game collectibles, digital real estate, entertainment content, and fan-engagement experiences. Other examples of popular NFT collections today include NBA Top Shots, Decentraland, and Axie Infinity. NFTs, while often talked about as one collective group, vary greatly in terms of what gives them their perceived value. Some of these factors include scarcity, appearance, popularity, and utility. For this reason, we provide a high-level framework for the valuation of an NFT, rather than comparing one type of NFT to another.

Part II: WHAT ARE THEY WORTH?

NFTs, as mentioned previously, possess multiple qualities that determine their value. NFT pricing research is still nascent, but this chapter was written to provide a helpful framework for determining just how much an NFT could be worth. To demonstrate each of these qualities in action, we provide an example to help cement your understanding.

SCARCITY: HOW MANY ARE THERE IN EXISTENCE?

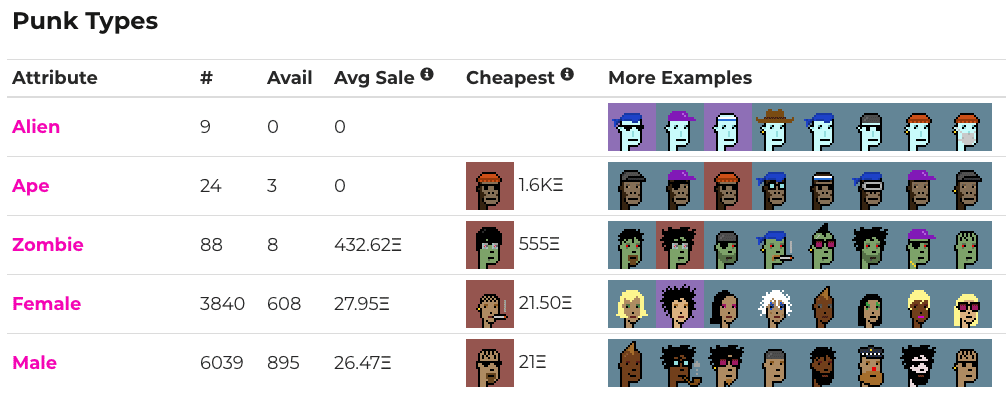

This goes back to the basic concept that, all else equal, the scarcer something is, the greater its price will be; NFTs minted as 1 of 1 (only one in existence) will be perceived as more valuable than 1 of 10000. However, NFTs within the same collection can have different rarities that contribute to their relative pricing as well. The graphic below demonstrates this effect:

Fig. 1: This chart shows how much each type of CryptoPunk has sold for within the last 90 days of its capture. Notice that as the number of existing NFTs for a certain type decreases, the price collectors are willing to pay increases. The average sale price for Apes and Aliens is indicated as 0, but this is only the case since ‘Avg Sale’ is recorded for the past 90 days. The sale price for Apes and Aliens is much higher. Source: https://www.larvalabs.com/cryptopunks/attributes

While many NFT collections use attributes with different rarities to drive value, others exhibit a tiering system to differentiate between common, rare, and legendary NFTs. NBA Top Shots is a popular NFT marketplace and platform for buying, selling, and trading clips of iconic NBA moments. Figure 2 shows that as the tier of the NFT increases, the total number of them decreases, which leads to both higher bids and asks.

Fig. 2: NBA Top Shots, to date, have accrued $660.45 million in total volume. Users can collect Top Shots that vary in terms of their scarcity. Typically, the higher its scarcity, the higher its price.

Source: https://nbatopshot.com/

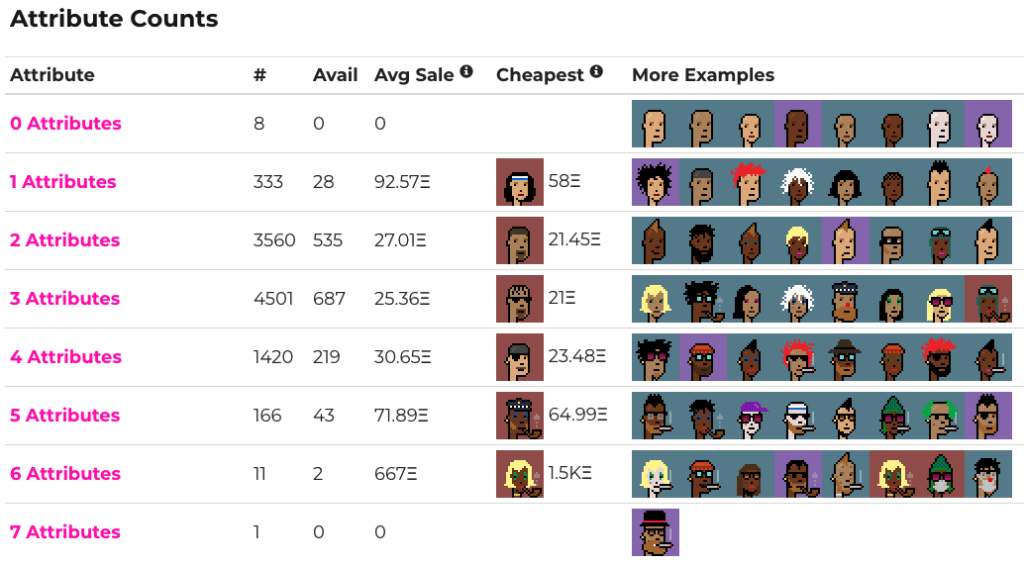

Fig. 3: While specific to CryptoPunks, the number of attributes contained within the NFT can be used to quantify the scarcity of the NFT and gives an indication as to the approximate value. Notice, however, there is an anomaly in that CryptoPunks with 1 attribute have a substantially higher value than those with 2, 3, and 4 attributes. This is likely due to the fact that there are fewer of them.

UTILITY: CAN THEY BE USED?

Does the NFT grant the holder some form of special utility or benefit of ownership? While most NFTs are created for the sole purpose of serving as a collector piece, many are now being created with some form of utility.

Decentraland is a decentralized VR platform, whereby users can explore virtual lands and attractions built by other members of the community. Because the number of virtual real estate spaces is limited to ninety thousand, the virtual real estate market behaves like the physical one to some extent; larger, more centrally located areas are valued greater than areas on the outskirts. Additionally, purchasing multiple, adjacent lots in a popular area will attract higher bids than single, isolated lots. Having adjacent lots allows participants to build even larger structures.

NFTs are now creating new opportunities for fan-engagement experiences. They can now serve as immutable proofs of ownership for a ticket to an event or a redeemable coupon for a unique experience. Gary Vaynerchuk, a prominent entrepreneur, has created an exclusive convention for holders of his new ‘VeeFriends’ NFT collection. In addition to serving as a ticket to VeeCon each year until 2024, some of the NFTs grant the holder the opportunity to redeem and schedule a meetup with Gary himself. These could include a FaceTime, breakfast/lunch/dinner meetup, pick-up basketball game, or even a fishing trip. It is easier to imagine that NFTs with these utilities will be worth more than those without them.

NFTs could serve as both a collectible, and a usable item in-game. Most in-game items were generated without proof of who owns what and how many were in existence. Now, game developers are starting to catch on to the use of NFTs as in-game items, allowing players to either customize their avatar or equip them with an exceedingly rare item.

Since the beginning of the year, Axie Infinity, a new game which utilizes a “play-to-earn” model, has grown over 30x. Players can earn roughly $10-20 in the form of the game’s native digital asset each day by selling their avatars, winning battles, or completing challenges2. Additionally, players that earn rare Axies in the form of NFTs can sell them on an open marketplace for someone else to use them in-game.

New developments around the usage of certain NFTs, such as in-game items or fan engagement experiences, has created demand for them. If the platform or brand through which the NFT is used increases in popularity, it is reasonable to suggest that the price of the NFTs driving that platform will also increase. On the other hand, NFTs that were meant solely as collectors’ pieces might not fetch as high a price, as they cannot be used for anything other than displays of digital art or content.

DESIRABILITY: IS IT POPULAR?

Non-fungible tokens have become known as a way for starving artists to step into the spotlight. Once established brands and influencers caught on to this trend, they realized that these technologies could be leveraged to create scarce digital assets that their fanbases would gladly purchase. The list of brands and influencers that have jumped onto the NFT bandwagon is long, and includes music artists, restaurant/food brands, athletes, YouTubers, and even the New York Stock Exchange.

Information that allows us to quantify the popularity of a certain brand or individual, while imperfect, can still give a certain indication of desirability. Metrics will vary based on the source of the data but could be useful when aggregated. These might include the number of total followers, active viewers, or fans a celebrity or a certain piece of content might have. When comparing the potential value of two NFTs before initial sale, consider how the popularity of the creators or the content behind the NFTs could affect their sale price. To reiterate, because there may be statistical biases between the fans of one brand and those of another, this is not the only metric that should be relied upon. Having some indication of the brand, however, will be helpful in the long run.

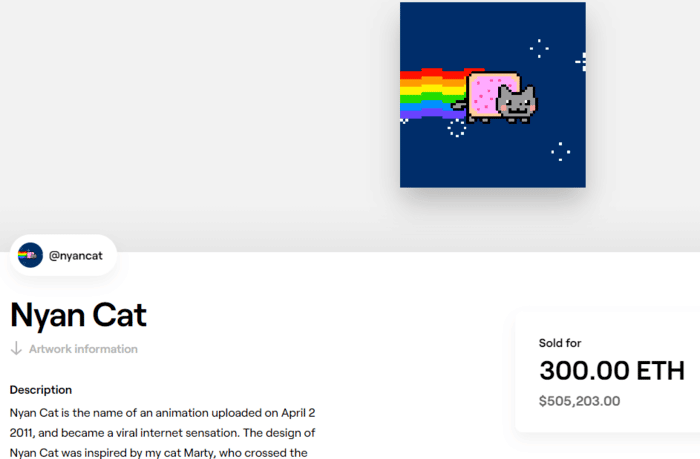

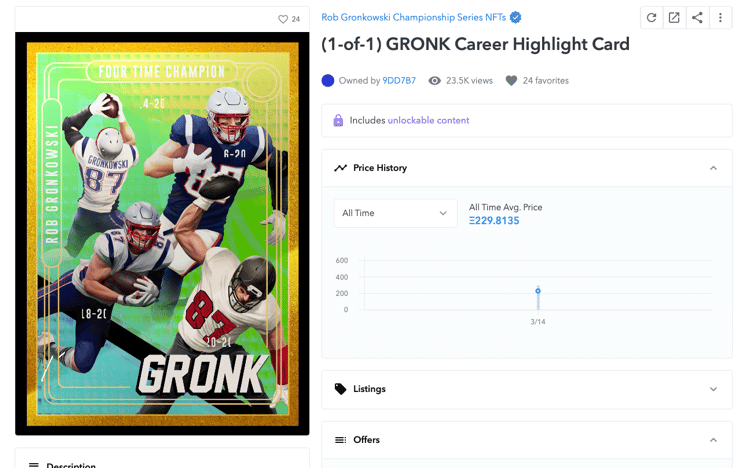

Fig. 3: Iconic internet GIFs and athlete endorsed NFTs are only two examples of ways in which brands and popular icons are being leveraged to generate demand for these digital assets. Sources: https://foundation.app/@NyanCat/nyan-cat-219, https://opensea.io/assets/0x495f947276749ce646f68ac8c248420045cb7b5e/63396559382108366891552229105139045122666232910269256654657359362664106557441

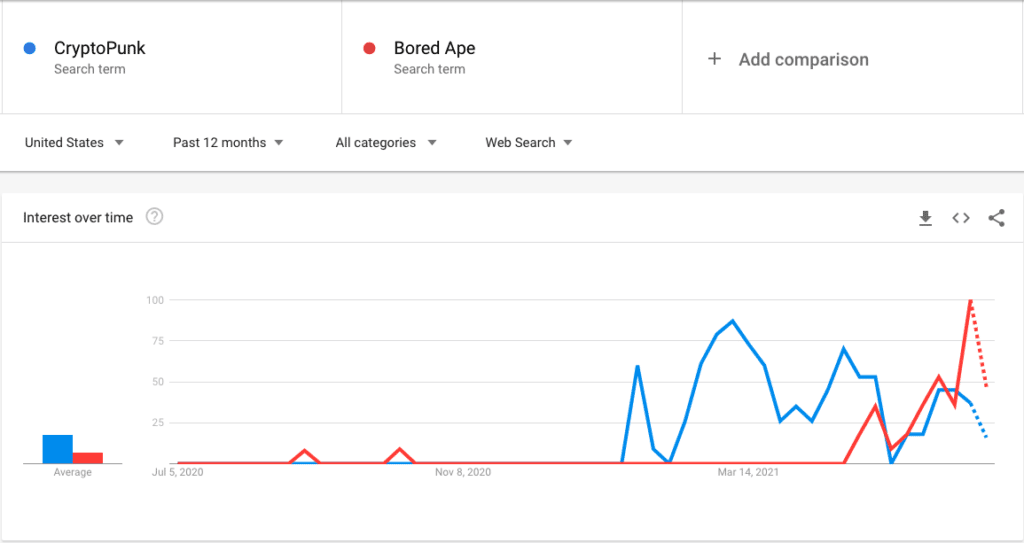

Fig 3: Bored Apes, according to Google search analytics has seen an increase in popularity over CryptoPunks. To date (July 2021), Bored Ape Yacht Club sits at #2, right behind CryptoPunks, in terms of all-time volume. Source: Google Trends

One useful way of determining the desirability of NFTs is by plotting and comparing Google Search Trends. Fig. 3 above contains a comparison between the search trends for ‘CryptoPunk’ and ‘Bored Ape Yacht Club’, another trending NFT collection. Bored Apes, at least for the short term, have surpassed CryptoPunks with respect to search term frequency. Knowing this information could give us an indication of where the price of certain NFTs is heading relative to other NFTs collections.

AUTHENTICITY: IS IT REAL?

NFTs, by their very nature, are immutable records of ownership associated with a piece of content. Differentiating between fake and authentic digital assets has never been easier now that users can investigate to see whether the NFT in question originally comes from an authentic brand or individual. However, given that scammers have successfully sold fake NFTs for payment, the only challenge that remains is teaching users how to check the authenticity of an NFT and why they should. Fake versions will almost always sell for either substantially less or not receive any bids.

OTHER THINGS TO CONSIDER

Now that we’ve covered the main factors to consider (scarcity, desirability, utility, and authenticity), we use this section to touch on any other important observations.

First off, does the buyer have to be interested in the art as a collector piece? Not at all. If the potential buyer has enough reason to believe that the NFT will be worth more in the future than what they bought it for, there will be a reason to purchase.

Next, while the technology was built to verify ownership of digital assets, is there anything stopping original NFT minters from releasing additional copies of the same NFT? Not necessarily. For now, this is something that digital artists have avoided doing to look out for their own best interests. On the one hand, an NFT creator’s reputation plays largely into the value of the NFTs themselves. On the other, perhaps an NFT platform could be created to ensure collectors that they have exclusive rights to the IPs in terms of their exploitation for the use of other NFTs.

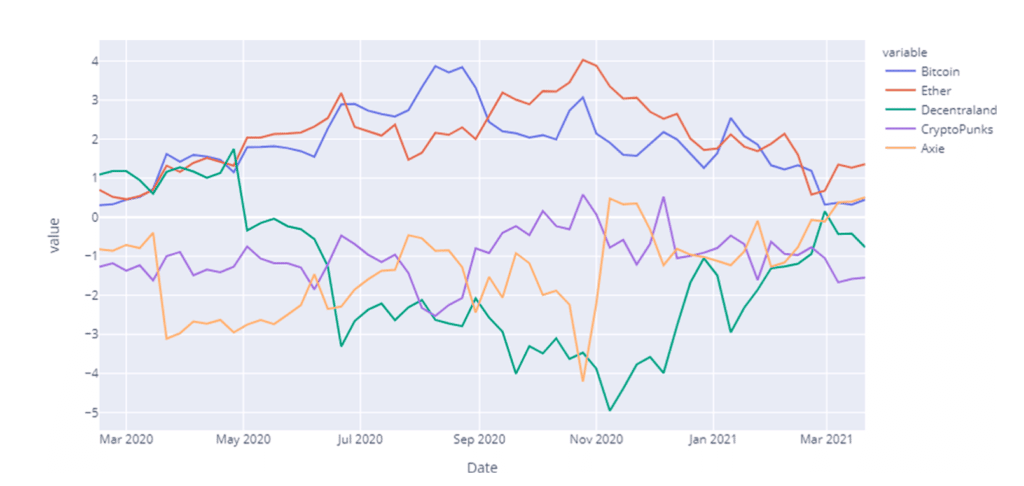

The best reflection of value, after all these factors considered, is manifested in the lifetime volume of the NFT collection. Apart from the total volume, NFT collection values have mostly been shown to move independently of one another. Michael Dowling demonstrates this by showing the relative spillovers between CryptoPunks, Decentraland, and Axie Games NFTs. He also includes the net spillovers for Bitcoin and Ether1:

Fig. 4: This chart shows that over most of 2020, and leading into 2021, these three NFT collections have moved independently of one another. In fact, Dowling shows that the markets for Bitcoin and Ether moved more closely with each other than the NFT collections over this same time span1. Keep in mind that the prices of NFTs are largely denominated in Ether.

While NFT collection values are largely independent of one another, it is possible to suggest that NFT collections with similar attributes will have a similar pricing dynamic.

As more participants buy into NFTs and create liquidity around them, we will have a better indication of the relationship between price and certain attributes. Once NFT marketplaces reach a certain level of liquidity, we can more accurately determine how a specific form of utility, level of scarcity, and popularity contribute to an NFT’s value. For now, paying attention to the attributes discussed in this chapter will give a potential buyer or seller a better estimation of the NFT’s marketprice.

CONCLUSION

NFTs are here to stay without a doubt. The advent of purchasing digital art or content with irrefutable evidence of ownership is changing the way we purchase them. With NFTs, we have new ways of monetizing and putting a value on certain content. However, many factors come into play when trying to determine just how much an NFT is worth. In this report, we provided a high-level framework that one could use to get a better sense of an NFT’s value.

RESOURCES

[1] Dowling, M. (2021, April 29). Is non-fungible token pricing driven by cryptocurrencies? Finance Research Letters. https://www.sciencedirect.com/science/article/pii/S1544612321001781.

[2] https://consensys.net/blog/metamask/to-infinity-and-beyond-the-growth-of-axie-infinity/